Demand for cyanamide (mostly 50% AS) has been rising constantly over recent years.

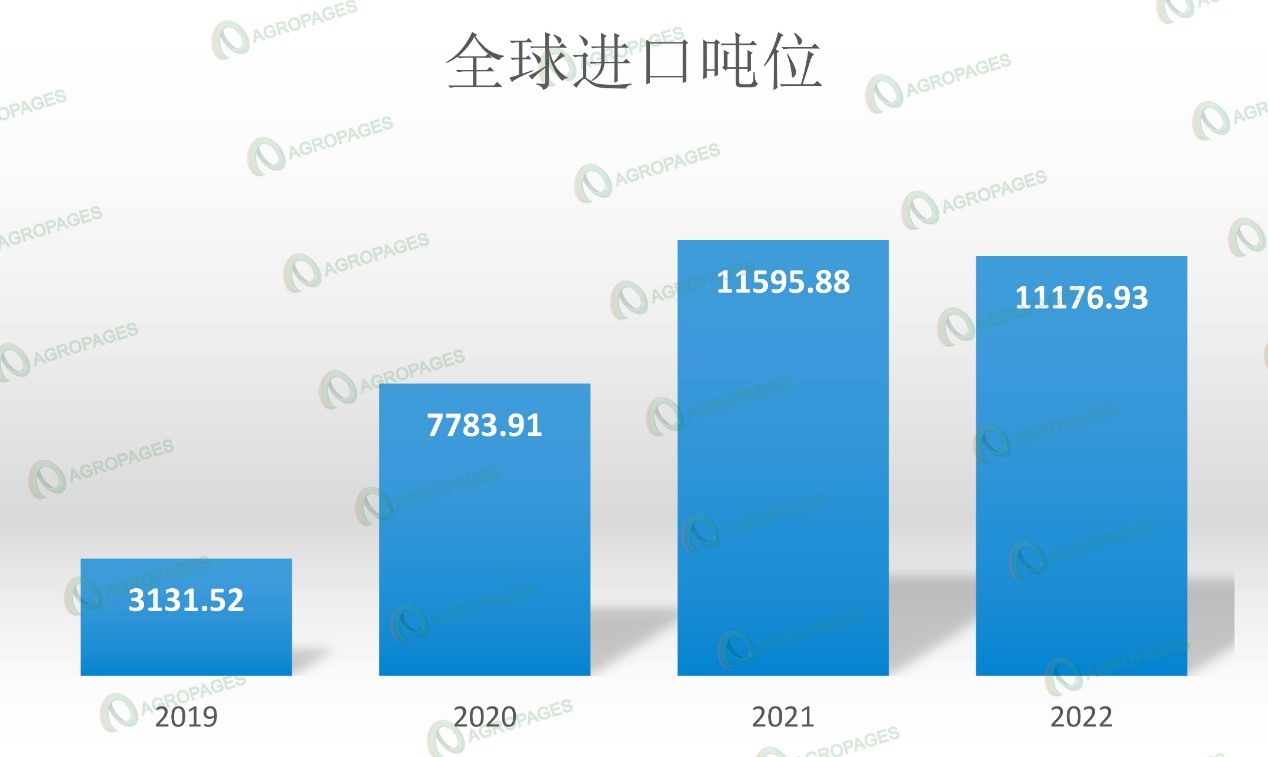

According to incomplete statistics, the import of cyanamide worldwide was only 3,131.5 tons in 2019, which reached 11,595.8 tons in 2021, with an average annual growth of 98%. From January to October 2022, the import volume already reached the level of the full year of 2021 as all countries have been increasing import. It is understood that cyanamide of the specification is mainly for application to plant dormancy breaking, having become a leading product for application to dormancy breaking, with a stable market (Exclusive of risk of prohibition and restriction in the future).

Total Global Import Volume (ton)

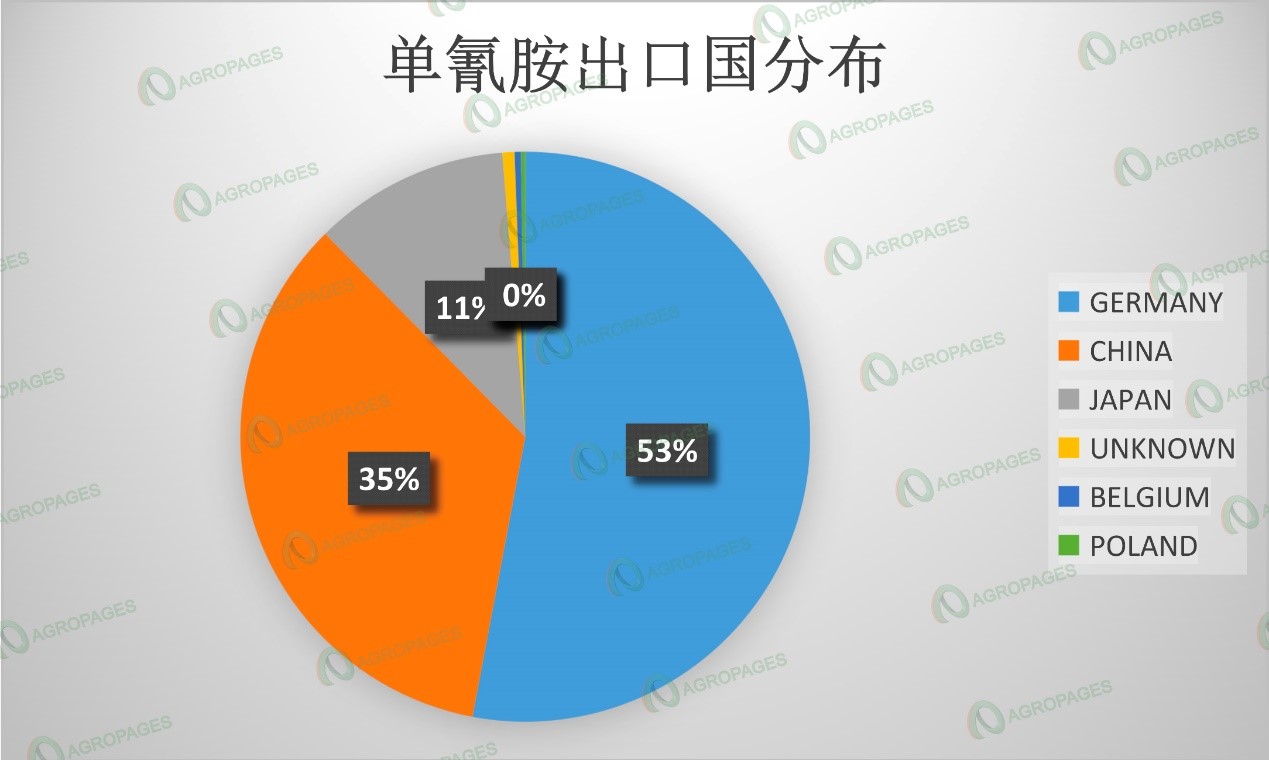

In terms of supplier countries, Germany is the main source of supply in 2022. According to incomplete statistics, Germany takes up 53% of global supply (ALZCHEM being major supplier), having exceeded the Chinese supply for the first time in recent four years. In 2019, The German supply of cyanamide only accounted for 19% of the global supply, which grew to 25.6% in 2020, and 37.5% in 2021. As cyanamide is a downstream product of calcium carbide, while China has made full effort to regulate high pollution and energy consumption-related industries in the past few years, the supply of cyanamide and calcium carbide have been much restrained.

Cyanamide Export Countries

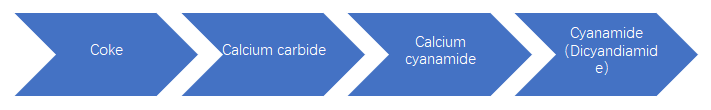

It is because of the close link between cyanamide and the source of the industry that the cost of production of cyanamide is directly impacted by supply and pricing of calcium carbide.

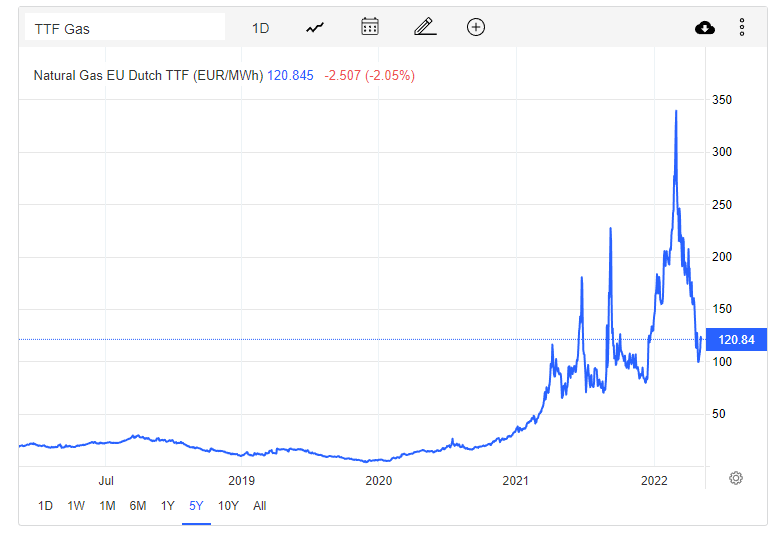

Production of one ton of cyanamide 50% needs 1.65 tons of Calcium cyanamide with 300 kilowatt hours of electricity; one ton of Calcium cyanamide needs 0.8 tons of calcium carbide; and one ton of calcium carbide needs 3,000 kilowatt hours of electricity. As a result, the production cost of one ton of cyanamide is affected substantially by the cost of calcium carbide. As of the press time, the natural gas futures linked to the European natural gas wholesale price TTF was €120 per megawatt hour, which is close to the five-month low point in October, less than 1/3 of the summer peak of €339, being still twice of the $65 per megawatt hour in October 2021.

To make a calculation at €120 per megawatt hour, the gas price is equivalent to RMB8.64/cubic meter (Chinese industrial gas price being RMB2/cubic meter) for gas with calorific value of 8,400 Cal/m3. Based on the calculation of 85% combustion efficiency, each cubic meter of natural gas can generate electricity of 3.321 kilowatt hours, at RMB2.6 of the cost of natural gas per kilowatt hour of electricity (China’s industrial electricity supplied at RMB0.5/kwh). For one ton of calcium carbide, the cost of production in Europe only in respect of power generation is RMB6,300 higher than that in China, and the production cost of cyanamide will be RMB7,000 higher than that in China. For a product sold at $3,800/ton (50% AS), 40% cost increase is a big disadvantage to the stable production and supply of the product. As a consequence, the product may face a risk of reduction of production or even suspension of production in Germany.

Nevertheless, the good news is that Europe has increased natural gas import from Norway and Azerbaijan, as well as purchase of liquefied natural gas from the United States. Spain is the largest natural gas reception center in Europe, with about 33% of Europe’s reception capacity and about 44% of storage capacity. However, Spain can only make available six berths, but as many as 35 transport ships are queuing up. In addition, more transport ships are arriving in Spain. According to an international strategy researcher, the freight charge for natural gas delivered to Europe has even exceeded the natural gas price, which leads to negative gas prices. Due to the impacts of high inventory and the expectation of a warm winter, a sharp declination in the European natural gas price is foreseen.

However, the real decisive factor is whether the war in Ukraine will continue, and whether the resolution to limit the electricity tariff on large industrial consumers to $7 cents/kilowatt hour, as proposed by the German natural gas expert committee, will become effective from January 1, 2023. These will be direct factors affecting stable operations of German manufacturing industry in the future, which will decide the future sustainable production of cyanamide, a product too close to the upstream of the industry chain.